The value of orders in the first half of 2025 is 21.2% higher than for the average year, whereas units ordered in the first half of 2025 are 17.2% lower.

Posted by Elizabeth Engler Modic, Editorial Director – Manufacturing Group

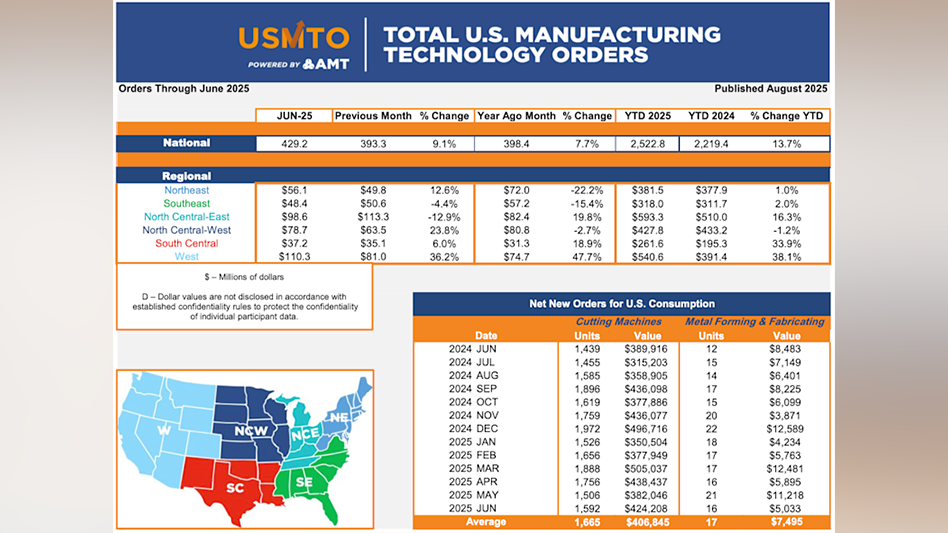

New orders of metalworking machinery, measured by the U.S. Manufacturing Technology Orders Report (USMTO) published by AMT – The Association For Manufacturing Technology, totaled $429.2 million in June 2025. This was a 9.1% increase from May 2025 and a 7.7% increase from June 2024. Machinery orders placed through June 2025 totaled $2.52 billion, a 13.7% increase over the first half of 2024.

The value of orders in the first half of 2025 is 21.2% higher than for the average year, whereas units ordered in the first half of 2025 are 17.2% lower. This trend underscores the increasing importance that automated machinery has played in the market for manufacturing technology in recent months, with added options and features increasing order values. Such automated solutions allow companies to gain additional productivity at current workforce levels, bridging the gap caused by the shallow, upward trend of industrial output and the continued decline in employment.

Uncertainty has been the primary economic driver through the first half of 2025, and the first few weeks of the second half show few signs of that instability abating. In AMT’s Summer Economic Update Webinar on Aug. 7, Oxford Economics revised its forecast upward to show modest single-digit growth in machinery orders in 2025. While this is an improvement over their previous estimates, it implies a significant decline in order activity to erode the 13.7% growth gained through the first half of 2025. At the same time, ITR Economics forecasts a strong second half of 2025 for cutting tool consumption, lifting orders for the year. While these forecasts seem at odds at first glance, cutting tool consumption tends to peak about two quarters after a peak in machinery orders. As the rest of 2025 unfolds, the health and trends of U.S. consumers and businesses will reveal if the momentum thus far will continue – or if cyclical peaks are on the horizon.

U.S. manufacturing technology orders surge to $429.2 million in June 2025 – Today's Medical Developments